By automating repetitive tasks, your team can focus on higher-value activities like strategic financial planning, customer relationship management, and resolving complex payment issues. They’ll have more time for strategic work that requires human judgment and interaction. Automated software handles tasks like entering data, creating invoices, and generating reports—minimizing manual effort and human error. Essential functionalities include automated invoice generation, real-time payment tracking, customizable payment reminders, and comprehensive reporting tools. Manual processes are prone to human errors, from data entry mistakes to missed follow-ups on unpaid invoices.

What are the Features of AR Automation Software?

- Electronic invoicing ensures invoices reach customers wherever they are, and can directly integrate with their AP systems to simplify payment processing through 3-way matching.

- Learn the many benefits of AR automation and how it can help businesses overcome the impact poor invoicing and collections practices have on cash flow and CX.

- Implementation timelines vary depending on the complexity of your current AR processes and the software selected.

- You will get details such as customer information, invoice details, shipping documents, Bills of Lading (BOL), payment options, aging tasks, and comments on a single platform.

- Automating processes cuts down on mistakes by reducing manual data entry and paperwork.

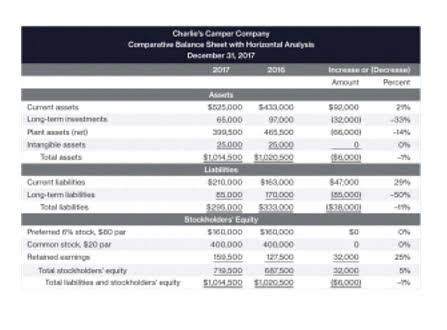

- Analyze the financial impact by calculating cost savings, revenue growth, and bad debt reduction.

3 – Involve the Accounts Receivable Team in the Discussion-While thinking to implement the software, it is advisable to include the accounts team. This will give a better exposure to the team as well and the company can also get the required inputs from them. It will keep the team members updated with the recent trends and can get insights on what exactly is needed for the betterment of the company.

What Is AR Automation

Robotic process automation (RPA) tackles the tedious, repetitive tasks that often bog down AR teams. Think of RPA as a digital worker that handles tasks like generating and sending invoices, sending follow-up reminders, and processing payments. For example, RPA can automatically send invoices and payment reminders, ensuring timely payments without manual real estate cash flow intervention. AR automation provides valuable data and insights into your financial operations. By tracking key metrics like days sales outstanding (DSO) and average payment time, you can identify trends and areas for improvement.

Eliminate Human Errors

Invoicing or payment reconciliation mistakes can lead to delays, disputes, and compliance risks. AR automation reduces the risk of errors by ensuring accurate data entry, real-time verification, and seamless integration with other financial systems. From labor costs to printing and mailing fees, businesses spend thousands on AR tasks that could be fully automated.

Start searching for the top online software or talk to the respective consultant to get a clear idea. In a world where time is increasingly more valuable, it’s critical to save time where you can and invest the rest of your valuable time into other beneficial endeavors. AR automation is the software that will help excel your business’s productivity and save you tons of time. Teams also gain valuable, actionable insights into which customers require immediate attention, letting the software handle the rest. Consequently, the AR team can prioritize their collection efforts and handle exceptional cases more thoroughly. This article will investigate the benefits of AR automation and discuss how it can help accounts receivable automation businesses overcome the invoicing delays that ripple throughout the financial org.

Is accounts receivable a debit or credit?

It reduces the process of entering data manually, thanks to its features that allow it to take and store payment terms, invoice details and customer-specific information. When inputting data during purchase, it remains in the customer’s account throughout the payment journey. For instance, if a client is supposed to be billed on a particular date, say the 5th of every month, it will automatically generate and deliver invoices on that day. AR automation is simply automating all or a part of your accounts receivable process. Using an automation solution improves the efficiency and accuracy of the whole process (we’ll see all its benefits later on).

- Each step that’s automated helps the entire process run more smoothly while also freeing up time to spend on other value-adding tasks.

- Access real-time analytics that put all billing and accounts receivable collections information at your fingertips.

- This frees up your team to focus on strategic activities like building customer relationships and refining your product.

- Cash flow is critical for every company, but collecting client payments on schedule and handling accounts receivable can sometimes be difficult.

- Versapay offers integrated collaboration, actionable insights, effortless invoicing, and real-time visibility across customers, divisions, and countries.

- Accountants and bookkeepers can then use AR automation to offer more value to B2B clients, working together with their clients to improve cash flow and help their businesses grow.

Learn the secrets to run successful meetings with your team using our expert contra asset account tips that can boost efficiency and engagement. Our review of Buffer vs Later can help you decide which one is best for you. Reputable AR automation providers prioritize data security using encryption, secure servers, and regular security audits.

- As your business expands its markets, you may be required to adhere to several geographical-specific requirements.

- Upflow for instance, centralizes and tracks in real-time customers’ payment timelines and cash application.

- Corcentric enables your business to contain costs, optimize cash flow, and mitigate risk.

- This eliminates manual data entry, reduces errors, and keeps customer and invoice information always in sync.

- In fact, it’s an ideal way to centralize and streamline simple internal accounts receivable tasks.

That’s why investing in financial automation to optimize processes like order-to-cash (O2C) is a top priority for CFOs in 2023. Because it’s all automated, you also reduce the risk of human error – and when you compute your AR using manual processes, mistakes are bound to happen. Once payment is received, the receipt is automatically created and applied to the billing—and from there, automatically cleared on a bank reconciliation.